Our third post covering our recent educational conference takes a look at current events in supply chain. Our presenter was Jeremy Banta, self-described as a “supply chain nerd,” college instructor in logistics, a frequent speaker and an active member of MHI’s WERC (Warehousing Education Research Council).

Jeremy summarized real. ripped-from-the-headlines examples of some companies who are currently crushing the distribution game, and those who seem to be trouble.

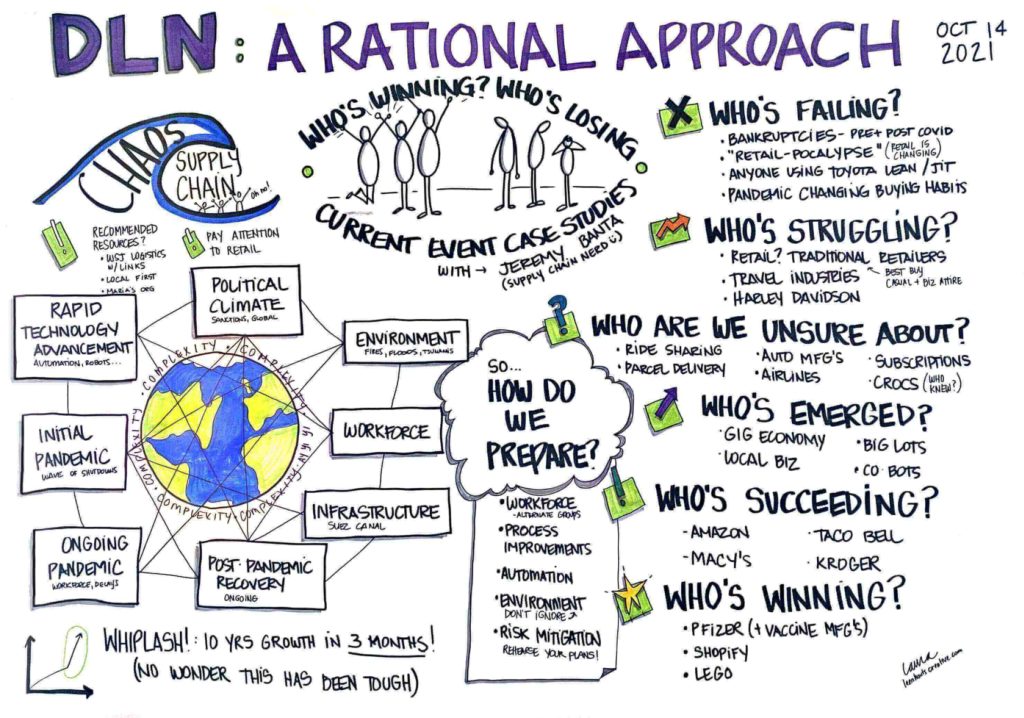

To make the point that several forces are at play to create a market of great complexity, Jeremy shared an article with the headline “Tidal Wave of Chaos Engulfs Global Supply Chains.” Tech advancements, political climate, environmental and social issues, infrastructure challenges – not to mention labor shortages – are working together to make supply chains unpredictable. A recent McKinsey report suggests we leapt forward 10 years in just 90 days time.

Who Is Failing?

COVID bankruptcies include JCPenney, J.Crew, Neiman Marcus, New York & Co., Sur La Table, and many more. These are added onto the bankruptcies announced 2018-2019: Sears, Forever 21, Payless, David’s Bridal, Mattress Firm, and so many more. The audience learned that companies using JIT model/Lean/Toyota model were not pivoting fast enough based on market conditions.

Who Might Be on the Brink?

Based on Jeremy’s regular review of industry news, he suggests several industries that might be struggling. Traditional retailers that relied on foot traffic are seeing a surge of online buyers, whereas clothing brands that sell business attire and the travel industry are making an unsteady comeback.

A few industries are in limbo. Automated vehicles, automobile manufacturers, and ride sharing companies are struggling for a variety of reasons – such as labor and supply challenges and consumer demand.

Who Is Emerging, Succeeding & Winning?

The gig economy providing food and meal delivery services (GrubHub and DoorDash) are looking strong. BigLots, a discount retailer, has opened a number of new stores, and Tractor Supply Company is doing well.

The biggest non-surprise on this list is Amazon. They continually re-invest profits into technology and improvements, so they are never really “done” with innovating operations. Macy’s is doing great due to an aggressive growth program they are following — which focuses heavily on supply chain. Kroger is investing strongly in bolstering suppliers and looking at alternative delivery options include drones.

The strongest performers in supply chain are Pfizer and other vaccine manufacturers, for moving fast not only on development but also distribution. Shopify (and other shopping cart / eCommerce services) performed as strong as anyone would expect based on the emphasis on eCommerce during the pandemic. And finally, LEGO is building on it’s number one position as world’s toy maker with major investments in digital platforms and bricks and mortar store building.

Use These Stories to Prepare for the Future

A few common themes emerged in our journey through the headlines. First, several companies that are succeeding and winning are creating optimal workforce. From adding flexibility in schedules, using alternative workforces, raising pay and focusing on culture, companies are focused on their human resources.

Another theme is the winners are continuing to invest in their own process improvements. While it’s easy to forgo spending when there is a lot of uncertainty, the wisest companies don’t let off the gas when it comes to trying new things, adding facilities and improving processes. LEGO, Kroger, and Shopify are succeeding in diverse industries but the thing they all have in common is adding technology and taking risks in spite of a volatile business environment.

What do you think? Is it possible to sustain investment during uncertain times or is it better to be safe? We’d love to hear your thoughts!