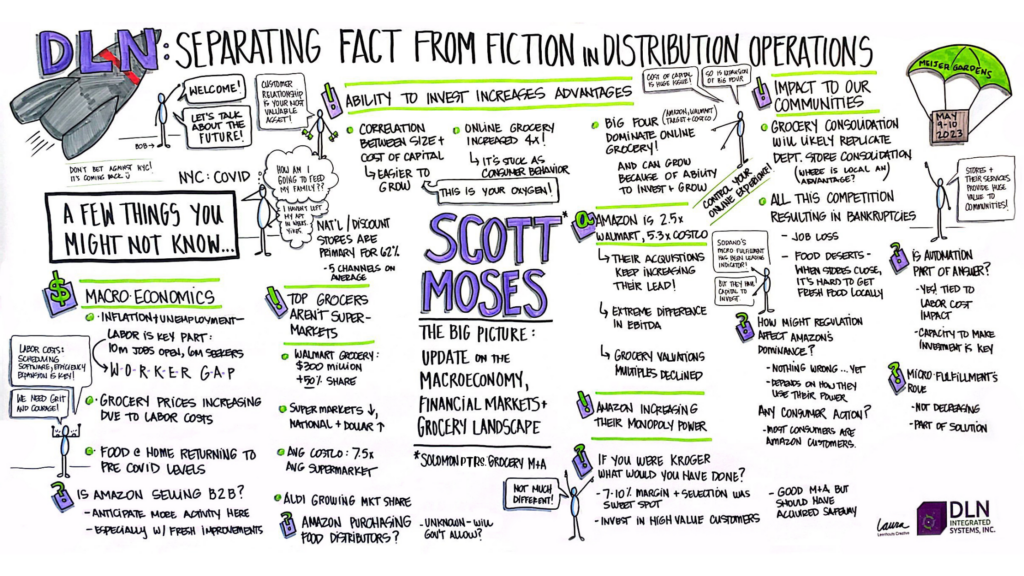

DLN Educational Conference – Speaker Scott Moses

Every other year DLN hosts an educational conference, where we hear from a handful of experts from academia & industry on topics that matter most to our clients. Our recent 2023 conference centered on the topic “Separating Fact & Fiction in Distribution Operations.”

This post covers the talk we heard from Scott Moses, Managing Director & Head of Grocery, Pharmacy & Restaurants Investment Banking at Solomon Partners and Author of a Supermarket News column.

Scott examined the grocery sector as a business school case study, organizing his talk by Macroeconomics, Microeconomics, Corporate Finance and Fragmented Sector (drawing parallels to department stores).

Macroeconomics

There are several positive developments in the broad economy. Inflation is cooling, The New York Fed’s Global Supply Chain Pressure Index decreased considerably in March 2023 and is below the 25-year historical average, and elevated grocery demand continues.

A few concerns are that the credit market remains volatile with the recent decline in confidence in regional banks, the housing market has cooled with higher interest rates, and U.S. GDP growth has slowed since Q4 2022.

Microeconomics

In the grocery sector, the pandemic caused an unprecedented shift in demand for food-at-home, although this has been tapering. National / discount grocers account for far more grocery sales than supermarket grocers. These national grocers include Walmart, Costco, Target, Amazon, Dollar General, Aldi and traditional supermarket grocers include Kroger, Albertsons, Ahold Delhaize, Publix, HEB and other regional supermarkets.

Corporate Finance

Scott highlighted how much better access to capital has allowed the biggest grocers to become even bigger by prioritizing investment into their businesses. Amazon, Scott says, is “drowning in cash to invest in growth,” and what that means for their supermarket competitors is that the need to scale isn’t just for profits – it is ultimately needed to survive. The challenge here is that the largest operators have a higher credit rating and lower cost of capital than their smaller peers – so the largest companies get much cheaper money to invest in growth than regional players.

Fragmented Sector

Scott shared that national / discount grocers (especially clubs like Costco and Dollar Stores like Dollar

General) are growing rapidly as the number of supermarkets is shrinking. He describes how grocery consolidation is beginning to mirror department store consolidation that has happened over the past 30 years. In 1990, there were dozens of department store chains all around the country that have slowly consolidated to be fewer, large players. Brands like Marshall Fields, Younkers, Mervyns, Woolworths have all disappeared as Walmart, Target, Amazon, and specialty retailers rapidly grew, leaving a few other major department store players like Kohl’s and Macy’s.

Takeaways

- Supermarket grocers are facing strong competition from national / discount grocery giants, which are now the majority of U.S. grocery sales

- 10 out of 15 of the top American grocers are NOT supermarkets

- Dollar grocery stores and club stores have had meteoric grocery growth

- National / discount grocery giants’ low cost of capital is fueling an investment “arms race” particularly online, where they are they are leaders

- The biggest players will continue to scale – smaller players need to scale to survive (not just compete)