The Cost of Not Thinking Through Material Handling Investments

Part one of a two-part series.

At some point a company realizes it needs to expand distribution capacity by opening a new facility or repurposing an existing one to meet changing business needs. The challenge is usually driven by growth – whether organic or the result of an acquisition, or by changes in the business such as shifting volume to direct-to-consumer sales, expanding to other product lines, or serving different types of store formats.

This is the start of the journey, when attention turns to consideration of major investments to solve new distribution problems. Without a thorough analysis, organizations risk project delays, costly rework, or even complete standstills due to uncertainty about the right solution.

A Case In Point

Situation

- We were approached by an apparel company seeking to expand.

- Initially, they were considering building a new facility to increase capacity and improve e-commerce order fulfillment, as their existing network primarily supports wholesale distribution.

Our Approach

- To support their decision-making, we conducted a comprehensive assessment of their current infrastructure to identify improvement opportunities and evaluate critical obsolescence in their systems.

The Results of Assessment

- Indicated greenfield facility would not be necessary for another 4-5 years.

- Implementing targeted changes, they could accommodate additional volume and effectively manage e-commerce orders.

- Our technicians developed a prioritized list of critical components that require replacement, enabling the company to enhance performance and extend the life of their existing systems.

Why is Careful Analysis More Important than Ever?

Rising Cost of Capital

The cost of capital is higher, and the scale of projects has grown, so organizations need to carefully weigh whether they can extend the lifespan of existing facilities. By doing so, they can defer significant capital expenditures associated with building a new facility by a few years, optimizing resource allocations while maximizing the value of current assets.

Economic Volatility

Companies need to assess their level of exposure to changing business conditions, such as higher inflation, labor availability and potential tariffs. The rising costs of maintenance and labor could shorten the payback period for investment on new infrastructure, while the ominous threat of tariffs could be a factor for the opposite but not necessarily a deal-breaker. You need to understand the portion of investment that is subject to tariffs – typically it would be confined to equipment sourced from some international vendors. Each case might be different where one factor weighs more than the others, so having a good understanding of the impact of different levers is imperative.

Evolving Technology

Dramatic changes in systems and needs over the past 10 to 15 years have changed design thought process and decision-making. There are many new technologies to explore. Scalability makes some technologies more attractive for smaller operations that would have found it prohibitive in the past. Robotics and hybrid solutions are increasingly getting into spaces that traditionally have been handled by more mature applications such as conveyors or sorters. Ultimately, it’s difficult to distinguish the real deal from a mirage – in other words, a reliable and proven technology versus an attractive beta version from a startup.

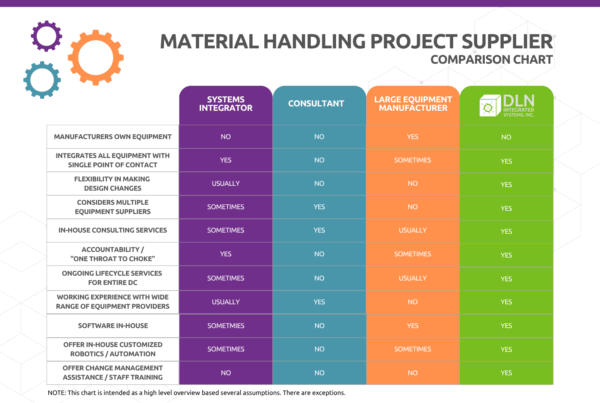

Advice Overload

The material handling space is now more crowded with equipment manufacturers, systems integrators and consultants. Many providers are expanding services in ways that overlap with the offerings of others. These dynamics make it confusing for organizations to identify the most suitable partners with relevant offerings for their specific needs.

Stay Tuned for Part 2!

Now that we’ve set the stage with WHY it’s important to do careful analysis, we’ll cover HOW to make the best investment decisions in our next post.

Plus we’ll share 5 tips to help you choose the right partner for your project.

About the Author

About the Author

Ricardo Parra, Senior Director of Professional Services

With 30 years supply chain experience, Ricardo has led operation transformation initiatives to develop solutions for dozens of major brands, helping them design complex material handling systems, optimize their footprints, develop ecommerce capabilities, and insource/outsource logistics.

In his current role he combines in-depth analytics and broad business and operational acumen to conceptualize practical and effective solutions, he is well versed in developing business cases and interfacing with executive decision makers.