Part 1 of 3

It was a cool, rainy morning in West Michigan, the kind that could easily put someone in auto-pilot mode.

But when participants from across the country walked into the Amway Grand conference room they quickly encountered an upbeat day full of value, connection, and learning.

Conference attendees, with a combined 797 years of supply chain experience, had compelling reasons to attend DLN’s educational conference in Grand Rapids, Michigan on May 13, 2025.

The senior managers, directors, corporate engineers, planners, and project managers from companies like Dollar General, Dollar Tree, Meijer and SpartanNash shared that they wanted to:

● Understand where the industry was moving.

● Hear from industry leaders outside their company.

● Understand if the changes/demands of fulfillment types create chaos or opportunity.

● Learn to get better strategic alignment with stakeholders.

● Grow their professional network.

● Become more valuable for their company.

What they received during the full-day event was an experience dedicated to meeting those desires and so much more.

What they received during the full-day event was an experience dedicated to meeting those desires and so much more.

Conference Moderator Michelle Shattuck said reflections from participants pointed to many common challenges and pain points across the industry.

There was a strong feeling that getting together with peers outside their company, at collaborative events like the DLN conference, was immensely valuable to solving those challenges. Supply chain professionals also expressed a real hunger for sharing knowledge more broadly across the industry.

The mindset in the room was optimistic. Shattuck sensed an undercurrent of opportunities instead of problems. The attendees were proactive and ready to figure things out.

With that stage set, let’s explore the first presentation of the day. Watch for Parts 2 & 3 to see highlights from the other presentations and recap the important takeaways that participants shared about their conference experience.

Riding the Wave: Adapting to Consumer Behavior Shifts

Nashville-based Lorelei Bergin, Vice President of Global Retail Strategy at NielsenIQ, kicked off the morning with thought-provoking data about the future of retail presented in a fast-paced, fun manner that kept the audience highly engaged.

Bergin, also an adjunct professor at Belmont University, said her company helps businesses determine what consumers do and buy, think and feel, and how to capitalize on opportunities while mitigating risk.

Bergin, also an adjunct professor at Belmont University, said her company helps businesses determine what consumers do and buy, think and feel, and how to capitalize on opportunities while mitigating risk.

She has observed the trend of big retailers keeping their customer data to themselves, forcing companies like NeilsenIQ to capture the market through alternative data sources such as the consumers themselves. Consumers are cashing in through methods like cash-back apps which help companies see what they are buying.

“I think that is going to happen everywhere,” Bergin said about tapping into consumers to learn about their purchasing habits.

Her talk focused on the six forces that are shifting the future of retail and why supply chain professionals must be aware of them. From the digital to the physical, these trends are redefining when, where, and how consumers shop. The retail forces are:

● Ecommerce acceleration

● Evolving store experience

● Delivery showdown

● Health and wellness

● Tariffs

● The future of tech/artificial intelligence (AI)

#1 – Ecommerce Acceleration

Bergin said online growth continues to outpace in-store growth, with self-care products sold online growing market share the fastest. Meanwhile the food and alcohol categories sold online still have a low market share.

“Food will be ripe for opportunity,” she told the audience.

Social selling is increasing and evolving, especially in the health and beauty category. TikTok Shop is currently the No. 8 health and beauty retailer, Bergin said. When she shared that there are just as many 65+ purchasers on TikTok as there are 18 to 24-year-old purchasers, the conference audience audibly gasped.

“It’s just too big,” Bergin said. “TikTok is not going anywhere.”

However, the brick and mortar footprint is shifting rather rapidly, Bergin said.

Dollar stores increased by more than 500 stores across the country last year, with small gains in supercenters and warehouse clubs as well.

However, drug stores experienced the greatest hit with the loss of more than 1,200 stores followed by the supermarket and convenience store categories.

#2 – Evolving Store Experience

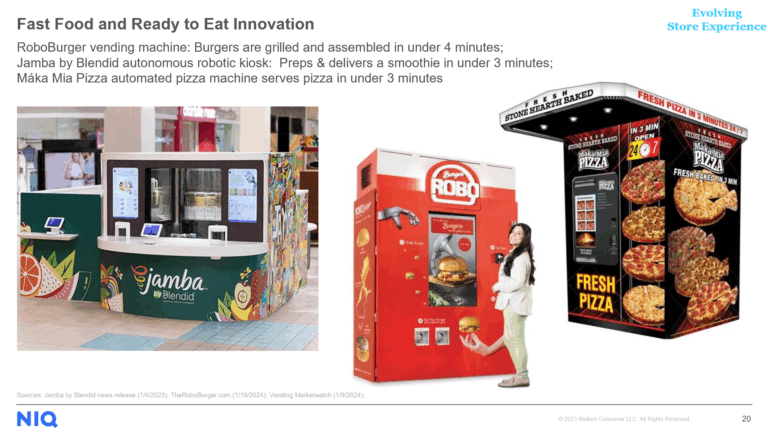

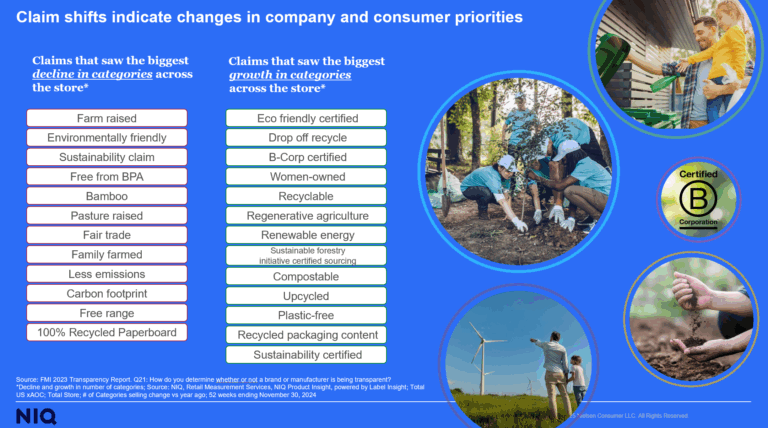

Looking at the gains made by deep discount grocers like Aldi and Save-A-Lot, Bergin shared that some grocers have rolled out their own no-frills formats. Others like Trader Joes have introduced grab-and-go stores. Ready-to-eat innovations also are offering meals out of vending machines in minutes.

#3 – Delivery Showdown

Delivery subscription models also continue to grow for major retailers from Target to Wal-Mart to Kroger. Bergin shared that many TV streaming services are even partnering with delivery apps to build up their customer base. An example shared was a partnership between Disney and Kroger that will give Boost With Kroger Plus members ($99 a year) a subscription of their choice to ad-supported Disney+, Hulu or ESPN+ at no extra charge.

#4 – Health & Wellness

Consumers, especially younger generations like Gen-Z, are more tuned in to their health and what they are putting in their bodies. There’s also an increased focus on certain ingredients in food. But when they can’t find enough healthy options in-store, consumers ultimately go online.

“That’s the mistake I see all these retailers making,” she said.

#5 – Tariffs

Looking ahead to the future, Bergin concluded her presentation talking about tariffs and AI.

When asked about tariffs specifically, a majority of Americans expect a negative impact on the US economy throughout the rest of this year and continuing for the next three years, Bergin said. Supply chain professionals, she said, must monitor this shaky consumer confidence as it will impact revenue projections.

#6 – AI

Finally, Bergin said digital experiences and AI will creatively impact shoppers to enhance convenience and save time.

Consumers are more open to AI involvement in their shopping decisions, but generational variances are clear, she said. Forty-seven percent of Gen Z consumers would accept a product recommendation from their AI assistant versus only 20 percent of Boomers.

“We have to learn how to adapt,” she said about AI.

Click for Part 2

Covering developing supply chain talent!

Click for Part 3

Covering modernizing DC operations for competitive advantage!