Outgrowing Your 3PL?

Many organizations reach a point where outsourcing to a third-party logistics (3PL) provider no longer aligns with their strategic, operational, or financial goals. This guide outlines the threshold for transitioning to in-house fulfillment, the recommended steps to execute a successful move, common pitfalls to avoid, and a pragmatic comparison of costs (CapEx and OpEx).

What’s the Threshold for Moving Away from 3PL to In-House Fulfillment?

Business Strategy

- You’re evolving toward fulfillment as a competitive advantage—prioritizing differentiated service levels, faster delivery promises, or specialized handling.

- You’re shifting to a balanced or hybrid model—retaining 3PL relationships for specific geographies or programs while building core capabilities in-house.

- You’re expanding or consolidating existing in-house fulfillment infrastructure to support growth, margin protection, and better alignment with company objectives.

Costs

- 3PL costs are escalating or volatile—especially as you push for continuous improvement in KPIs like order accuracy, cycle time, and dock-to-stock.

- The unit economics are no longer favorable—additional surcharges or activity-based fees erode margin as volume grows.

Control

- You need deeper visibility into product flow and inventory—especially for sensitive products, stringent quality standards, or specialized workflows.

- You want tighter integration across systems (ERP, OMS, WMS, TMS) to broaden supply chain control and enable end-to-end traceability.

- As you’ve grown, data privacy and cybersecurity risks are a bigger issue and you need better control of sensitive information.

Service Levels

- You’re targeting measurable improvements in customer experience—faster fulfillment speeds, “perfect order” rates, and consistent SLAs across channels.

- Your brand demands direct accountability for fulfillment performance.

- Current delivery times or error rates are unsustainable for growth.

Flexibility & Scalability

- Adaptation to demand shifts, new product launches, SKU expansion, and promotional ramp-ups—without dependency on third-party capacity constraints.

- You need the freedom to redesign processes and facilities to support evolving product and packaging needs.

Cost Comparison: 3PL v. In-House

3PL Cost Structure

- Storage: Charged by pallets or allocated space

- Handling: Per-unit, per-activity (receiving, picking, packing), or hourly (less preferred)

- Pricing includes: 3PL’s systems, infrastructure, and risk margin built into unit rates

- Start-up costs: Low to minimal for the client (the 3PL carries CapEx)

In-House Cost Structure

- CapEx: Land/building (or leasehold improvements), design/engineering, procurement, commissioning; IT systems & infrastructure; storage and material handling solutions

- OpEx: Labor (direct & indirect), utilities, maintenance, facility operations, consumables

- IT Systems & Infrastructure: Purchase, integration/commissioning, and ongoing support

- Non-personnel fixed costs: Utilities, property taxes, regulatory/compliance—less variable with volume

- Performance Accountability: The organization fully owns performance across variable demand

How economics shift over time

- In-house start-up costs are higher, but are amortized over multiple years.

- As volume grows and you optimize processes, systems, and labor, in-house unit costs often trend downward relative to 3PL rates—especially when you value control, service differentiation, and flexibility outlined in Section 1.

- A hybrid model can pace investment while preserving agility (e.g., in-house for core SKUs/regions, 3PL for overflow or specialized programs).

3 Pitfalls to Avoid

Pitfall 1: Insufficient Assessment & Readiness

- Avoidance: Establish a comprehensive readiness checklist covering operations, systems, staffing, supplier/carrier coordination, and risk mitigations. Run tabletop exercises and go-live rehearsals.

Pitfall 2: Sub-Optimal Fulfillment Solution Design

- Avoidance: Ensure process and facility design directly support target SLAs, volumes, SKU profiles, and seasonal peaks. Validate with real data and iterative simulations; prioritize flow efficiency (from dock-to-stock to last-mile).

Pitfall 3: Unstructured Transition or Poor Execution

- Avoidance: Use a formal PMO with cutover playbooks, dual-run periods (parallel operations), carrier and system cutover plans, and clear escalation paths. Maintain buffer inventory and contingency capacity during transition.

KPIs Measured Before, During & After The Move

- Order accuracy / “perfect order” rate

- On-time ship & delivery

- Dock-to-stock cycle time

- Pick productivity (lines/hour) & labor cost per order

- Cost per order / per unit

- Inventory accuracy & shrink

- Return processing cycle time

- Customer experience metrics

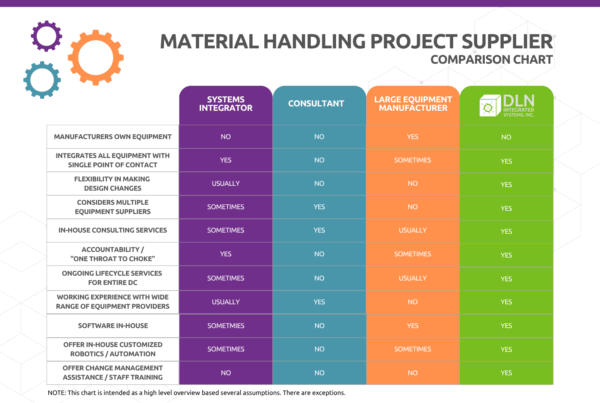

Who Is DLN & How Can We Help?

DLN Integrated Systems is an integrator with a robust in-house consulting practice, software, customized automation and robotics, and a knowledgeable lifecycle services team.

DLN Integrated Systems is an integrator with a robust in-house consulting practice, software, customized automation and robotics, and a knowledgeable lifecycle services team.

We conduct an in-depth assessment of your supply chain, transportation, and fulfillment strategies and models, covering:

- Qualitative & quantitative analysis of the thresholds above

- Organizational, operational, technological, and asset infrastructure readiness

- Gap assessment against target maturity

- Operational, financial, and service metrics (current vs. desired)

- Risk management for transition and steady-state operations

Deliverables typically include a decision framework, business case and a clear recommendation (stay with 3PL, hybrid or in-house).

Our team is committed to providing the optimal solution to our clients. Feel free to contact us to start a no-obligation conversation about your specific situation.